Intraday Update 11.30 Am:

BN found support at 18100 levels and has reached the 200 DMA.

TRADE PLAN:

Book out Longs and short with EOD close above 18510 - 200 DMA. OR Trail SL to 18350 -50 DMA - Hour Close.

Pre market View:

BN found support at 18100 levels and has reached the 200 DMA.

TRADE PLAN:

Book out Longs and short with EOD close above 18510 - 200 DMA. OR Trail SL to 18350 -50 DMA - Hour Close.

Pre market View:

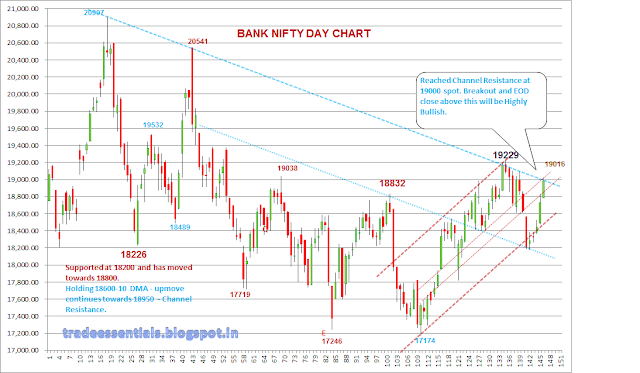

Two Scenarios' in play:

Bullish - c.B ended at 18034 and a new wave has started.

Bearish : iii ended at 18034 and

ongoing is iv. C.iv is pending and likely to resist at 18350 - 50 DMA and fall

to form new lows below 17900

SL for Positional Longs trailed to yesterday Low Book out at 18310 - 350 spot.

Sell at 18350 spot levels - SL EOD close above 18350 - 50 DMA.