3.15 PM update:

EOD close is likely to be above the Developing day LEMA and 20 DMA at 5661- but below thw week HEMA. So NIfty is likely to be in sideways mode for the coming week. Aggressive shorts can either be closed on Intraday basis at CMP - 5672 NS or carried on positionally with a Stoploss of 5690 NS - Day 5 EMA.

12.45 PM Update:

SL revised to 5698 Day 5EMA

11.45 AM update:

Based on Channel resistance & Day HEMA @5726 - Aggressive shorts has been initiated at 5730NF with SL hour close above 5725. Caution - 10 DMA @ 5708 and Day 5EMA @ 5698. If 10 DMA supports then 5725 would be taken out easily.

NIFTY HOUR CHART:

This blog is my trading diary. It is an attempt to organise my analysis and thoughts. I follow the charting methods given in JUST NIFTY blog by Ilango sir and so the charts would have striking resemblance to his charts. I am indebted to Ilango sir for having made this blog possible for me.

October 12, 2012

Analysis for Oct 12

Nifty Gathered support from 20 DMA and closed exactly at 10 DMA and below Day HEMA.

Today Being week close, A close below the Week HEMA @ 5699 would weaken Nifty. Strength if closed above the Day HEMA 5727.

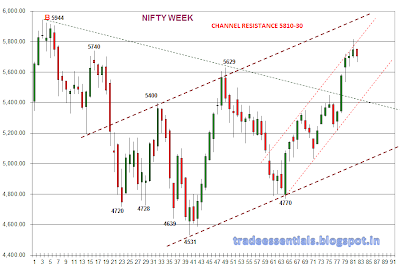

WEEK CHARTS:

If the -VE divergence in weekly charts comes to play then more downsides would be seen.

Today Being week close, A close below the Week HEMA @ 5699 would weaken Nifty. Strength if closed above the Day HEMA 5727.

WEEK CHARTS:

If the -VE divergence in weekly charts comes to play then more downsides would be seen.

If the -ve

divergence comes to play then Nifty would be dragged further down towards channel bottom.

October 11, 2012

Analysis for Oct 11

Nifty has closed below the all Day TA parameters - indicating weakness. If 20 DMA at 5633 extends support then a Buonce could be expected. EOD close above the Day LEMA would mean a sideways consolidation - which also happens to be a channel resistance.

5620 levels is also a likely support - which was previous resistance. Breakdown of 5620 would lead to 5585/5568/5530 levels.

Hour Charts:

5620 levels is also a likely support - which was previous resistance. Breakdown of 5620 would lead to 5585/5568/5530 levels.

Hour Charts:

October 10, 2012

Analysis for Oct 10

Nifty is correcting from the High of 5815 and has closed below the Day HEMA for past three days and gaining support at Day LEMA.

Few Charts Showing the Support and Resistances.

Few Charts Showing the Support and Resistances.