Intraday update 3.00 PM:

Holding shorts positionally as the SL was not hit.

Intraday update 1.00 PM:

| 23/01/2012 11:00 | 5,053.75 | 5,055.40 | 5,044.30 | 5,051.20 |

| 23/01/2012 12:00 | 5,051.20 | 5,052.45 | 5,032.25 | 5,036.90 |

| 23/01/2012 13:00 | 5,036.90 | 5,047.10 | 5,029.60 | 5,037.80 |

the low of 5029 exactly tests the lowerline of the rising wedge. Breakdown of the low would be breakdown of rising wedge.

Intraday Update 11.00 Am:

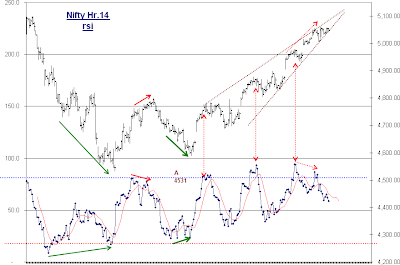

Hour chart with Divergences:

Aggressively shorted at 5050NS with SL Hour close above 5065.

ANALYSIS FOR JAN 23:

Nifty has easily moved past the Day, week and minthly resistance and is trading firmly above all 5 EMA's (monthly/weekly/and Daily) and ablve the week and Day Hema's.

As of now intraday weakness would set in only with a close below the Pivot - 5039 and subsequently the Day Hema of 4995.

| Week levels | |

| CLOSE | 5049 |

| PIVOT | 4980 |

| HI EMA | 4939 |

| LOW EMA | 4714 |

| 5 EMA | 4874 |

| 10 EMA | 4876 |

| PrevHigh | 5064 |

| Prev Low | 4827 |

| CHECK LIST-DAY | | | |

| CLOSE | 5049 | | |

| PIVOT | 5039 | 10EMA | 4918 |

| HI EMA | 4995 | 13EMA | 4893 |

| LOW EMA | 4941 | 26EMA | 4849 |

| 5EMA | 4980 | prev HI | 5064 |

| 5 SMA | 4973 | prev LOW | 5004 |

| 20 Hr MA | 4843 | 100 DMA | 4938 |

| 50 Hr MA | 4928 | 200 DMA | 5229 |

The Bearish Bat pattern has given its complete target of 5064 - 224% retr of BC.

The Bearish Shark pattern of the Day TF has reached 94.3% retr @ 5064.

5068 - is the 61.8% retr - GOLDEN RATIO for the leg from 5400 -4531.

BEARISH SHARK PATTERN:

OX - 5400 - 4639

A - 5099 - approx 61.8% retr of OX

B - 4531 - >113% and < 127% retrof XA

Proj for C:

88.6% of AB- 5034

94.43% - 5064 - achieved

113% - 5172

5172 is the initial taget for the Bearish shark pattern Day TF. Holding above the Day Hema this target is achieveable.

As the previous LONG entry which should have been taken at Day close above 4970 - Month 5EMA was missed - waiting for an oppurtunity to go LONG near the Day HEMA or DAY PIVOT.

| Trade Table | | |

| Current pattern | O-X | A | B |

| Bearish Shark pattern | 5400 - 4639 | 5099 | 4531 |

| Trade initiated | SL Day close below 4990NS | | |

| Buy above 5000-5030 NS | Projections for C | | |

| 88.60% | 5034.00 | |

| 94.43% | 5067.00 | |

| 113.00% | 5173.00 | |

| 127.00% | 5252.00 | |

AGGRESSIVE SHORTS CAN BE TAKEN AT 5060NS WITH SL HOUR CLOSE ABOVE 5070NS AND CAN CONVERT TO POSITIONAL IF DAY CLOSES BELOW ITS DAY HEMA - ELSE COULD BOOK PROFITS INTRADAY AT DAY HEMA.

| Retracements | |

| 5.57% | 5038.43 |

| 4588 -5065 | 9.02% | 5021.97 |

| 14.60% | 4995.36 |