Taking off from blogging for next two months - Shall resume by NEW YEAR!!!

This blog is my trading diary. It is an attempt to organise my analysis and thoughts. I follow the charting methods given in JUST NIFTY blog by Ilango sir and so the charts would have striking resemblance to his charts. I am indebted to Ilango sir for having made this blog possible for me.

November 8, 2012

November 6, 2012

ANALYSIS FOR NOV 6

Nifty is again rangebound between 5670-5720-25.

Breakout above 5720-30 desicively would be a Hour, Day and weekly Channels/Trendline Breakout.

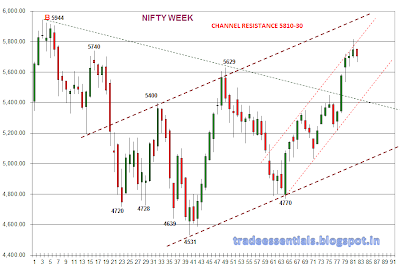

Week Chart:

Breakout above 5720-30 desicively would be a Hour, Day and weekly Channels/Trendline Breakout.

Week Chart:

October 25, 2012

Analysis for Oct 25

NIFTY LEVELS TO WATCH:

RESISTANCES:

DAY HEMA - 5717

WEEK HEMA - 5699

DAY 5 EMA - 5695

20 DMA - 5695

SUPPORTS:

10 DMA - 5685

DAY LEMA - 5663

200 HE MA - 5655

Resistances - also corresponds to trendline resistances and supports - pattern supports.

RESISTANCES:

DAY HEMA - 5717

WEEK HEMA - 5699

DAY 5 EMA - 5695

20 DMA - 5695

SUPPORTS:

10 DMA - 5685

DAY LEMA - 5663

200 HE MA - 5655

Resistances - also corresponds to trendline resistances and supports - pattern supports.

October 24, 2012

October 22, 2012

Analysis for Oct 22

IMPORTANT TA PARAMETER TO WATCH TODAY:

STRENGTH ABOVE -

5693 - 20 DMA

5700 - WEEK 5 SMA

5711 - DAY HEMA

WEAK BELOW:

5651 - DAY LEMA & TRENDLINE SUPPORT (REFER DAY CHART BELOW)

5657 - WEEK 5 EMA

Nifty trading between 5700 - 5650. Any breakout/breakdown of the levels would lead to huge moves. Currently Day trend is down with a close below Day 5 ema and Day HEMA.

So trailing the SL for shorts to 20 DMA - close above 5695.

STRENGTH ABOVE -

5693 - 20 DMA

5700 - WEEK 5 SMA

5711 - DAY HEMA

WEAK BELOW:

5651 - DAY LEMA & TRENDLINE SUPPORT (REFER DAY CHART BELOW)

5657 - WEEK 5 EMA

Nifty trading between 5700 - 5650. Any breakout/breakdown of the levels would lead to huge moves. Currently Day trend is down with a close below Day 5 ema and Day HEMA.

So trailing the SL for shorts to 20 DMA - close above 5695.

October 19, 2012

Analysis for Oct 19

Intraday Update 2.30 PM:

Trailing the Stoploss for the Shorts taken to Hour close above 5680 - 10 DMA/5 DMA

Trailing the Stoploss for the Shorts taken to Hour close above 5680 - 10 DMA/5 DMA

October 18, 2012

Analysis for Oct 18

Nifty closed below 5 EMA but above Day LEMA - extending the trading zone.

Today's important levels to be watched:

Day HEMA - 5705

Day LEMA - 5645

Day 5 EMA - 5670

Day 20 SMA - 5680.

Trading above 5705 and an Hour close above it would favour Upmove -

Trading below 5645 and an Hour Close below 5645 would favour downmove.

5715-5635 - Trading time.

WEEK CHART:

Today's important levels to be watched:

Day HEMA - 5705

Day LEMA - 5645

Day 5 EMA - 5670

Day 20 SMA - 5680.

Trading above 5705 and an Hour close above it would favour Upmove -

Trading below 5645 and an Hour Close below 5645 would favour downmove.

5715-5635 - Trading time.

WEEK CHART:

October 17, 2012

Analysis for Oct 17

INTRADAY UPDATE 3.15 PM:

Developing 5 EMA - 5666 , Day LEMA - 5645 - A likely close above Day LEMA but below Day 5 EMA. Again a narrow trading range. 20 DMA is 5679. SL for shorts EOD close above 5680.

Analysis for Oct 17:

Owing to global cues Nifty Might give a gapup. If trading above 5715 - day HEMA - initially an Hour close above 5715 - then strength in upward move.

The Channel resistance comes to around 5705-5710.

Breakdown below 5635. Trading oppurtuinities will continue between 5710-5635 - Between Day HEMA and Day LEMA.

EOD close above 20 DMA - 5675 would favour Bulls.

A definite Close either below the Day Lema or above the Day HEMA - would decide further moves.

Developing 5 EMA - 5666 , Day LEMA - 5645 - A likely close above Day LEMA but below Day 5 EMA. Again a narrow trading range. 20 DMA is 5679. SL for shorts EOD close above 5680.

Analysis for Oct 17:

Owing to global cues Nifty Might give a gapup. If trading above 5715 - day HEMA - initially an Hour close above 5715 - then strength in upward move.

The Channel resistance comes to around 5705-5710.

Breakdown below 5635. Trading oppurtuinities will continue between 5710-5635 - Between Day HEMA and Day LEMA.

EOD close above 20 DMA - 5675 would favour Bulls.

A definite Close either below the Day Lema or above the Day HEMA - would decide further moves.

October 16, 2012

Analysis for 16 OCT 2012

INTRADAY UPDATE 3.00 PM:

The fastfall has had its effect pushing nifty to 5635. An EOD close below the Day LEMA - developing 5650 - then More falls in on cards. A Close below 20 DMA - would give a pause to the Bulls. Shorts SL at 5680 - just above 20 DMA.

Analysis for OCT 16

Nifty resisted from Day HEMA travelled down upto Day LEMA. Breakdown of contracting triangle below 5650-40. Breakout of Contracting triangle above 5720. The Trading range would continue till the range is resolved.

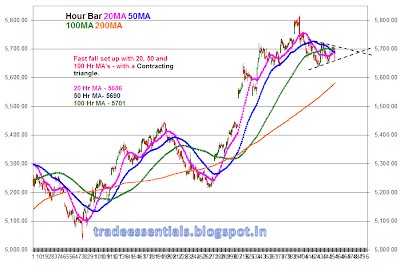

In Hour charts the MA's are alligned bearishly, with a fast fall set up between 20, 50 and 100 MA.

The fastfall has had its effect pushing nifty to 5635. An EOD close below the Day LEMA - developing 5650 - then More falls in on cards. A Close below 20 DMA - would give a pause to the Bulls. Shorts SL at 5680 - just above 20 DMA.

Analysis for OCT 16

Nifty resisted from Day HEMA travelled down upto Day LEMA. Breakdown of contracting triangle below 5650-40. Breakout of Contracting triangle above 5720. The Trading range would continue till the range is resolved.

In Hour charts the MA's are alligned bearishly, with a fast fall set up between 20, 50 and 100 MA.

October 15, 2012

ANALYSIS FOR 15 OCT

Nifty opened lower and till now could not sustain above 20 DMA - 5766. Struggling for support at Day LEMA @ 5658. If supported at Day LEMA first it would move towards 20 DMA and then towards Day 5ema -5690. Initial Strength returns on two Hours' close above Day 5ema @5690.

The charts indicate breakout only above 5700-5705. A breakdown below 5640 would be a descending traiangle/Head and shoulder breakdown.

WEEK CHART:

The charts indicate breakout only above 5700-5705. A breakdown below 5640 would be a descending traiangle/Head and shoulder breakdown.

WEEK CHART:

October 12, 2012

Intraday Update oct 12

3.15 PM update:

EOD close is likely to be above the Developing day LEMA and 20 DMA at 5661- but below thw week HEMA. So NIfty is likely to be in sideways mode for the coming week. Aggressive shorts can either be closed on Intraday basis at CMP - 5672 NS or carried on positionally with a Stoploss of 5690 NS - Day 5 EMA.

12.45 PM Update:

SL revised to 5698 Day 5EMA

11.45 AM update:

Based on Channel resistance & Day HEMA @5726 - Aggressive shorts has been initiated at 5730NF with SL hour close above 5725. Caution - 10 DMA @ 5708 and Day 5EMA @ 5698. If 10 DMA supports then 5725 would be taken out easily.

NIFTY HOUR CHART:

EOD close is likely to be above the Developing day LEMA and 20 DMA at 5661- but below thw week HEMA. So NIfty is likely to be in sideways mode for the coming week. Aggressive shorts can either be closed on Intraday basis at CMP - 5672 NS or carried on positionally with a Stoploss of 5690 NS - Day 5 EMA.

12.45 PM Update:

SL revised to 5698 Day 5EMA

11.45 AM update:

Based on Channel resistance & Day HEMA @5726 - Aggressive shorts has been initiated at 5730NF with SL hour close above 5725. Caution - 10 DMA @ 5708 and Day 5EMA @ 5698. If 10 DMA supports then 5725 would be taken out easily.

NIFTY HOUR CHART:

Analysis for Oct 12

Nifty Gathered support from 20 DMA and closed exactly at 10 DMA and below Day HEMA.

Today Being week close, A close below the Week HEMA @ 5699 would weaken Nifty. Strength if closed above the Day HEMA 5727.

WEEK CHARTS:

If the -VE divergence in weekly charts comes to play then more downsides would be seen.

Today Being week close, A close below the Week HEMA @ 5699 would weaken Nifty. Strength if closed above the Day HEMA 5727.

WEEK CHARTS:

If the -VE divergence in weekly charts comes to play then more downsides would be seen.

If the -ve

divergence comes to play then Nifty would be dragged further down towards channel bottom.

October 11, 2012

Analysis for Oct 11

Nifty has closed below the all Day TA parameters - indicating weakness. If 20 DMA at 5633 extends support then a Buonce could be expected. EOD close above the Day LEMA would mean a sideways consolidation - which also happens to be a channel resistance.

5620 levels is also a likely support - which was previous resistance. Breakdown of 5620 would lead to 5585/5568/5530 levels.

Hour Charts:

5620 levels is also a likely support - which was previous resistance. Breakdown of 5620 would lead to 5585/5568/5530 levels.

Hour Charts:

October 10, 2012

Analysis for Oct 10

Nifty is correcting from the High of 5815 and has closed below the Day HEMA for past three days and gaining support at Day LEMA.

Few Charts Showing the Support and Resistances.

Few Charts Showing the Support and Resistances.

September 28, 2012

September 26, 2012

Analysis for Sept 26

Nifty Ended as a DOJI - depicting indecisiveness to move further. Trading Below Day Pivot - followed by trading below Day HEMA 5665 would indicate weakness. EOD close below Day LEMA 5600 would drag Nifty further down. But considering the expiry tomorrow - close below Day LEMA is doubtful as Bulls are comfortably placed this expiry.

NIFTY WEEKLY CHARTS:

NIFTY WEEKLY CHARTS:

September 25, 2012

INTRADAY UPDATE SEPT 25

Update 1.00PM:

Booked aggressive Longs taken at 5660NS @ 5685NS .

A rising wedge is developing in Hour charts.

Aggressive buy Intraday @ 5660NS SL - 5650NS.

Booked aggressive Longs taken at 5660NS @ 5685NS .

A rising wedge is developing in Hour charts.

Aggressive buy Intraday @ 5660NS SL - 5650NS.

Analysis for Sept 25

Nifty is correcting from the New Highof 5720. With three more trading sessions for expiry, bulls would not give up easily, and 5600NS is likely to be protected. If the Day Closes below the Day HEMA 5648, then it is likely to test 5600-5580 - Day LEMA.

Today's Channel supports are at 5630-20NS Channel Resistances - 5710-20

The Hour charts are also exhibiting -ve divergences - which indicates caution at High Levels.

Today's Channel supports are at 5630-20NS Channel Resistances - 5710-20

The Hour charts are also exhibiting -ve divergences - which indicates caution at High Levels.

September 24, 2012

Analysis for Sept 24

Nifty had a huge Runup and has closed near the 52 week High. Now to charts:

NIFTY WEEK LONG TERM CHART:

Cluster of resistance at 5700 levels.

Considering the inverted H&S/Contracting triangle breakout - Nifty is likely to reach the CHANNEL TOP near 6100++ on taking out 5740 - previous High on a closing basis.

NIFTY WEEK LONG TERM CHART:

Considering the inverted H&S/Contracting triangle breakout - Nifty is likely to reach the CHANNEL TOP near 6100++ on taking out 5740 - previous High on a closing basis.

September 21, 2012

September 20, 2012

HAPPY GANESH CHATHURTHI

FOR GANESHA LOVERS - VINAYAGAR AGAVAL BY M.S SUBBULAKSHMI

As mentioned in Sept 18 post. Longs were added at 5560NF during opening Positional SL 5520NS.

September 18, 2012

ANALYSIS FOR SEPT 18

Nifty had a Huge run up with two gap ups. 75% of the Longs taken ( from sept 6th 5245NF) were booked out on Friday and Yesterday (5630NF). Continuing rest of the Longs with Stoploss 5525 EOD - based on Day HEMA.

September 14, 2012

Analysis for Sept 14

Nifty ended with a DOJI indicating indecisiveness. The +ve Global cues warrants for a good gap up opening. With the gap up it is likely to test the Resistance of Rising Wedge @ 5500.

September 13, 2012

Analysis for Sept 13

Nifty has closed just above the TREND LINE. Holding above 5395-5400 is important for the upmove to continue above 5500++.

September 12, 2012

ANALYSIS FOR SEPT 12

Nifty Has closed near the High and has closed above all parameters in Month, Week and Day TF. With respect to the TA parameters Nifty is in complete Bullishness - may be a time to excercise some caution - b'coz Nifty is likely to face trendline resistance at 5410-20. REFER CHARTS OF SEPT 11.

MONTH CHART:

MONTH CHART:

September 11, 2012

ANALYSIS FOR SEPT 11

Today's Support - 20 DMA/Day HEMA - 5328-5335. An EOD close below this would drag Nifty Down towards Day LEMA/50 DMA - 5280-70.

Now lets see what charts say:

DAY CHARTS:

Now lets see what charts say:

DAY CHARTS:

September 6, 2012

ANALYSIS FOR SEPT 6

INTRADAY UPDATE 3.00 pm:

Intraday trade done - Bought at 5245NF - and sold at 5275NF.

ANALYSIS FOR SEPT 6:

Nifty has poised in an interesting scenario. In the Monthly charts, it is seen that from the Month of April it has not scaled 5300 on Monthly Closing Basis. A Cluster of resistance is seen at 5300. Past two months, the Body of the Candle has been very narrow between 5285 - 5215- not even a 100 point range. It has been a spinning top both the previous months - showing high indecisiveness.

Intraday trade done - Bought at 5245NF - and sold at 5275NF.

ANALYSIS FOR SEPT 6:

Nifty has poised in an interesting scenario. In the Monthly charts, it is seen that from the Month of April it has not scaled 5300 on Monthly Closing Basis. A Cluster of resistance is seen at 5300. Past two months, the Body of the Candle has been very narrow between 5285 - 5215- not even a 100 point range. It has been a spinning top both the previous months - showing high indecisiveness.

September 5, 2012

HAPPY TEACHERS' DAY

MY PRANAMS TO ALL MY TEACHERS!!!! I PRAY GOD TO BLESS THEM WITH GOOD HEALTH AND PROSPERITY.

Nifty managed to scroll back and close above the 50 Day MA and Day Low EMA giving some hope for the Bulls.

September 4, 2012

Analysis for Sept 4

INTRADAY UPDATE:

Bank Nifty at Trendline Support:

ANALYSIS FOR SEPT 4:

Nifty has closed below the 50 DMA and all other Day parameters presenting a bleak picture. Supports at 5230-20 levels. An EOD close below these levels would drag Nifty further down to 5150 levels.

An Hourly close above the Day Pivot/ Day Lema @ 5265 levels would be the first hint of strength.

The Aggressive SL for the Longs taken is Hourly close below 5250NS. Positional SL would be an EOD close below 5200NS - based on trendline support and Month 5EMA @ 5214

Stop Loss for existing shorts would be EOD close above 5300NS.

If Nifty gains strength above 5290 and has a Hourly close above 5290, then Fresh Longs would be taken in case SL hits before.

Bank Nifty at Trendline Support:

ANALYSIS FOR SEPT 4:

Nifty has closed below the 50 DMA and all other Day parameters presenting a bleak picture. Supports at 5230-20 levels. An EOD close below these levels would drag Nifty further down to 5150 levels.

An Hourly close above the Day Pivot/ Day Lema @ 5265 levels would be the first hint of strength.

The Aggressive SL for the Longs taken is Hourly close below 5250NS. Positional SL would be an EOD close below 5200NS - based on trendline support and Month 5EMA @ 5214

Stop Loss for existing shorts would be EOD close above 5300NS.

If Nifty gains strength above 5290 and has a Hourly close above 5290, then Fresh Longs would be taken in case SL hits before.

| CHECK LIST-DAY | |||

| CLOSE | 5254 | 5 SMA | 5290 |

| PIVOT | 5264 | 5EMA | 5289 |

| HI EMA | 5328 | 10EMA | 5313 |

| LOW EMA | 5268 | 13EMA | 5316 |

| prev HI | 5296 | 20 Hr MA | 5270 |

| prev LOW | 5243 | 50 Hr MA | 5317 |

| 20 DMA | 5335 | 100 Hr MA | 5348 |

| 50 DMA | 5260 | 200 Hr MA | 5281 |

| 100 DMA | 5161 |

September 3, 2012

ANALYSIS FOR SEPT 3

Nifty ended the Month at a low of 5259 - just at the support of 50 day MA and Week LEMA - keeping the bulls hopes alive.

As mentioned earlier Nifty is currently at the support level of 5230-40.

DIAMOND PATTERN IN DAY CHARTS: to know about diamond patterns CLICK HERE

As mentioned earlier Nifty is currently at the support level of 5230-40.

DIAMOND PATTERN IN DAY CHARTS: to know about diamond patterns CLICK HERE

August 31, 2012

ANALYSIS FOR AUG 31

INTRADAY UPDATE 2.00 PM:

5240NS achieved. Aggressive Longs are taken at 5242NS (5275NF) with Stoploss 5220NS EOD - Break of Month 5EMA -

Stoploss for existing Shorts trailed to EOD close above 5310NS - above Current Day LEMA and Day 5EMA.

INTRADAY UPDATE 10.45 am:

BULLISHLY ALLIGNED MOVING AVERAGES

Possibility of Fast Rise between 50 and 100 Ma averages and 20 and 200 MA's.

An Hourly Close below the 200 Hr MA - currently 5277 - signals weakness.

5240NS achieved. Aggressive Longs are taken at 5242NS (5275NF) with Stoploss 5220NS EOD - Break of Month 5EMA -

Stoploss for existing Shorts trailed to EOD close above 5310NS - above Current Day LEMA and Day 5EMA.

INTRADAY UPDATE 10.45 am:

BULLISHLY ALLIGNED MOVING AVERAGES

Possibility of Fast Rise between 50 and 100 Ma averages and 20 and 200 MA's.

An Hourly Close below the 200 Hr MA - currently 5277 - signals weakness.

August 30, 2012

Analysis for Aug 30

Update 3.10 PM:

Booked out aggressive longs at 5310NS

UPDATE 2.45 PM:

NIFTY TESTING THE TRENDLINE - Support at 5240-50 levels. If supported the upmove would resume.

Booked out aggressive longs at 5310NS

UPDATE 2.45 PM:

NIFTY TESTING THE TRENDLINE - Support at 5240-50 levels. If supported the upmove would resume.

August 29, 2012

Analysis for Aug 29

HAPPY ONAM TO ALL!!!

Intraday Update 2.00PM:

As presented in the morning view, shorts were partbooked at 5295NS and aggressive Longs sttempted at same levels (sept NF - 5340) with SL 5270 NS Hourly CLOSE corresponding to 200 Hr Moving Average.

STOPLOSS FOR CURRENT SHORTS TRAILED TO 5350NS - EOD CLOSE CORRESPONDING TO DAY 5 EMA.

ANALYSIS FOR AUG 29:

Nifty moved down to 5315 yesterday - trying to gain support at weekly Ema but has closed below the Day Lema of 5346. On a break of 5310, Nifty might test 5265-70 - weekly Lema. The Oversold Hour TF might produce a Pull back owing to expiry pressure. The past two weeks was in the hands of Bulls and they would not give up so easily. The week Hema is 5365 and the Month Hema is 5380. Bulls would try to conquer this level owing to

a) Expiry,

b) Week End and

c) Month End.

The Day Hema is 5392 and Day Lema is 5346. Today a close above the Day LEMA 5346 would give a temporary pause for the downmove and put Nifty in side ways.

The Stoploss for the shorts initiated at 5390NS on 27th (SeptNF 5420) is 5380NS on closing basis.

PARTBOOKING is prudent at 5280-5300NS.

Aggressive Longs can be attempted at 5280 - 5300 NS with strict SL 5260 NS and can be booked out at 5320, 5340 or 5360 levels corresponding to week 5 EMA, Day LEma and week Hema levels.

August 27, 2012

Analysis for Aug 27

Intraday Update: 1.45 PM:

Hour Chart:

The current Low of 5365 is supported by the Channel. Day Lema is 5369, Month High EMA is 5379, 13 Day SMA is 5364. If Nifty gains support at this level - being expiry week and month end, a pull back is possible.

Analysis for Aug 27:

Nifty has given mixed signals with weak Day TA by closing below the Day HEMA and Day 5 EMA, and a strong WEEK TA with a close above the week HEMA and week 5 EMA.

Going by the Day signals 50% Short is initiated at opening 5390NS with PositionalSL 5455 NS. Though the Sl seems to be large with 50 Points, being the expiry week and month end too - the risk is taken.

Shall upload the charts later.

would add to shorts upto level - 5430-45NS. with SL -5455 NS.

Hour Chart:

The current Low of 5365 is supported by the Channel. Day Lema is 5369, Month High EMA is 5379, 13 Day SMA is 5364. If Nifty gains support at this level - being expiry week and month end, a pull back is possible.

Analysis for Aug 27:

Nifty has given mixed signals with weak Day TA by closing below the Day HEMA and Day 5 EMA, and a strong WEEK TA with a close above the week HEMA and week 5 EMA.

Going by the Day signals 50% Short is initiated at opening 5390NS with PositionalSL 5455 NS. Though the Sl seems to be large with 50 Points, being the expiry week and month end too - the risk is taken.

Shall upload the charts later.

would add to shorts upto level - 5430-45NS. with SL -5455 NS.

August 20, 2012

August 17, 2012

Analysis for Aug 17

Nifty has reached the RESISTANCE POINT of the weekly/Monthly chart with a High of 5398. It also coincides with the 113% retrcement of 5349-5032 - Develoing into a BULLISH SHARK PATTERN (Click Here).

NIFTY MONTH CHART;

NIFTY WEEK CHART:

NIFTY MONTH CHART;

NIFTY WEEK CHART:

August 13, 2012

Analysis for Aug 13

BANK NIFTY DAY CHART:

BULLISH GARTLEY PATTERN IN BANK NIFTY:

Bullish Gartley Pattern:

XA - 9622 - 10782

B - 10056 - 61.8% retr

C - 10640 - approx 78.6% retr of AB

Holding C, Proj for D:

61.8% - 10279 - DONE

78.6% - 10180

88.6% - 10122

113% - 9980

The Trendline Has been Broken downwards - signalling more downsides to come - towards the CHANNEL bottom. If Bank Nifty moves above 10355 the it would agan creep back above the Trendline to Triangle Top.

Till 10355-370 is taken out EOD more downsides will follow.

NIFTY HOUR CHART UPDATE:

BREAKDOWN OF THE CHANNEL WOULD LEAD TO MORE LOWS.

An EOD close below 5300 - below day 5 EMA/Day HEMA would lead to more lows and the Bullish Shark Pattern (CLICK HERE) is likely to continue. So at such juncture the Longs are to be terminated and Fresh Shorts taken with SL above Day HEMA.

BULLISH GARTLEY PATTERN IN BANK NIFTY:

Bullish Gartley Pattern:

XA - 9622 - 10782

B - 10056 - 61.8% retr

C - 10640 - approx 78.6% retr of AB

Holding C, Proj for D:

61.8% - 10279 - DONE

78.6% - 10180

88.6% - 10122

113% - 9980

The Trendline Has been Broken downwards - signalling more downsides to come - towards the CHANNEL bottom. If Bank Nifty moves above 10355 the it would agan creep back above the Trendline to Triangle Top.

Till 10355-370 is taken out EOD more downsides will follow.

NIFTY HOUR CHART UPDATE:

BREAKDOWN OF THE CHANNEL WOULD LEAD TO MORE LOWS.

An EOD close below 5300 - below day 5 EMA/Day HEMA would lead to more lows and the Bullish Shark Pattern (CLICK HERE) is likely to continue. So at such juncture the Longs are to be terminated and Fresh Shorts taken with SL above Day HEMA.

August 9, 2012

Analysis for Aug 9

Intraday Update 3.00 PM:

Aggressive shorts booked Intraday at 5320NS/5340NF levels. Created Long at 5320 NS with SL EOD close below 5295 - 10 Points below 5EMA.

ANALYSIS FOR AUG 9:

A firm weekend closing and a Gap Up on Monday Aug 6th has firmly put Nifty on the uptrend path and the Bullish Bat Harmonic Pattern has got invalidated on a Move above 5349 and now it is either the the continuation of 5-0 Pattern - REFER JULY 31 ANALYSIS AND CHART (CLICK HERE) OR Development of Bullish Shark Pattern.

An Inverted Head and Shoulder has formed in the Day Charts and currently NIFTY is at the Neckline of the H&S.

INVERSE HEAD AND SHOULDER

If Neckline Resisted, then the Bullish Shark Pattern would be the result

If Breakout occurs then it would be the continuation of the 5-0 Pattern

MONTHLY CHART:

WEEKLY CHART: Currently resisting at Trendline/Contracting Triangle.

HOUR CHART : NIFTY within Channel:

SYNOPSIS:

Aggressive shorts taken at 5375NF today morning with 5405 NS STRICT STOPLOSS. - based on Trendline/Inverted H&S/Channel Breakout.

Supports can be expected at 5344 Ns -Month HEMA, 5330 Developing HEMA hence book out aggressive shorts intraday at these levels.

Positional shorts should be carried forward only on CLOSE BELOW DAY HEMA 5325NS.

IF EOD CLOSE ABOVE DAY HEMA 5330, THEN BUY AT 5330-40 LEVELS WITH STOPLOSS BELOW 5320 DAY HEMA

Aggressive shorts booked Intraday at 5320NS/5340NF levels. Created Long at 5320 NS with SL EOD close below 5295 - 10 Points below 5EMA.

ANALYSIS FOR AUG 9:

A firm weekend closing and a Gap Up on Monday Aug 6th has firmly put Nifty on the uptrend path and the Bullish Bat Harmonic Pattern has got invalidated on a Move above 5349 and now it is either the the continuation of 5-0 Pattern - REFER JULY 31 ANALYSIS AND CHART (CLICK HERE) OR Development of Bullish Shark Pattern.

An Inverted Head and Shoulder has formed in the Day Charts and currently NIFTY is at the Neckline of the H&S.

INVERSE HEAD AND SHOULDER

If Neckline Resisted, then the Bullish Shark Pattern would be the result

If Breakout occurs then it would be the continuation of the 5-0 Pattern

MONTHLY CHART:

WEEKLY CHART: Currently resisting at Trendline/Contracting Triangle.

HOUR CHART : NIFTY within Channel:

SYNOPSIS:

Aggressive shorts taken at 5375NF today morning with 5405 NS STRICT STOPLOSS. - based on Trendline/Inverted H&S/Channel Breakout.

Supports can be expected at 5344 Ns -Month HEMA, 5330 Developing HEMA hence book out aggressive shorts intraday at these levels.

Positional shorts should be carried forward only on CLOSE BELOW DAY HEMA 5325NS.

IF EOD CLOSE ABOVE DAY HEMA 5330, THEN BUY AT 5330-40 LEVELS WITH STOPLOSS BELOW 5320 DAY HEMA

August 5, 2012

HAPPY FRIENDSHIP DAY !!!

On this day I would like to thank all my FRIENDS - for what they have done to me to be as I AM!!! Thanks a Lot all of you!!!!

August 3, 2012

Analysis for Aug 3

Nifty defended the 20 DMA yesterday but today at opening it opened below the 20 DMA - indicating weakness. Todays close below 5220 would set the way for further down moves.

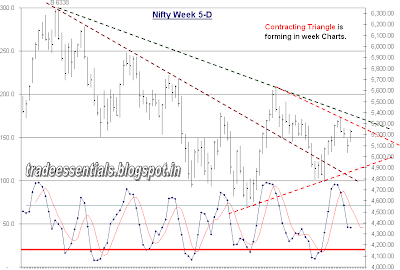

The weekly charts clearly shows the formation of Contracting Triangle. Today being the weekend - Closing above the week 5EMA at 5191 is the minimum requirement for some more upsides.

Nifty Day Charts seems to be Highly Overbought and ready for correction. A close above 20 DMA/Day HEMA at 5220 is a must for more upsides. Hence correction is imminent to follow.

Harmonic pattern Chart: (REFER AUG2 WRITE-UP)

The weekly charts clearly shows the formation of Contracting Triangle. Today being the weekend - Closing above the week 5EMA at 5191 is the minimum requirement for some more upsides.

Nifty Day Charts seems to be Highly Overbought and ready for correction. A close above 20 DMA/Day HEMA at 5220 is a must for more upsides. Hence correction is imminent to follow.

Harmonic pattern Chart: (REFER AUG2 WRITE-UP)

| Trade Table | |||

| Current pattern | X-A | B | C (current) |

| BULLISH BAT PATTERN | 4770-5349 | 5032 | 5246 |

| Trade initiated | SL EOD close above 5220 | ||

| SOLD at 5210NF on 3AUG | Proj for D | ||

| 38.20% | 5164.00 | aprrox 100 DMA & 10 DMA | |

| 50.00% | 5139.00 | 50 DMA | |

| 61.80% | 5113.00 | week LEMA | |

| 78.60% | 5077.00 | ||

| at today's opening the Longs were closed at 5220NF and shorts were taken | |||

| Developing Week Levels | |

| CLOSE | |

| PIVOT | 5201 |

| HI EMA | 5337 |

| LOW EMA | 5114 |

| 5 EMA | 5191 |

| 5 SMA | 5215 |

| 10 EMA | 5172 |

| PrevHigh | 5164 |

| Prev Low | 5032 |

| CHECK LIST-DAY | |||

| CLOSE | 5228 | 5 SMA | 5199 |

| PIVOT | 5225 | 5EMA | 5204 |

| HI EMA | 5219 | 10EMA | 5190 |

| LOW EMA | 5170 | 13EMA | 5189 |

| prev HI | 5237 | 50 Hr MA | 5161 |

| prev LOW | 5210 | 100 Hr MA | 5177 |

| 20 DMA | 5208 | 200 Hr MA | 5214 |

| 100 DMA | 5151 | ||

| 200 DMA | 5105 |

August 2, 2012

Analysis for Aug 2

INTRADAY UPDATE BANK NIFTY HOUR CHART RISING WEDGE:

The Upmove in Rising wedge is resited by the TRENDLINE.

Analysis for August 2:

Nifty Closed the July month well above the Month 5 EMA and 20 DMA. While it is trying to defend the 20 DMA, Nifty is struggling hard to breakout above the 61.8% retr level of 5246 too. More upsides possible only on a breakout above 5246. Weak below 20 DMA.

The Rising wedge (CLICK HERE for july 31 chart) seems to have Broken and as per the charts of July 31 (CLICK HERE) - the Alternate 2 seems to be in place till 5246 above 61.8% is taken upward.

The Hour14 RSI and Hour Fmacd charts also exhibit -ve divergences - so breakdown of the rising wedge seems to be a possibility.

Bullish Bat Pattern:

Bullish Bat Pattern:XA - 4770 - 5349

B - 5032 - 50% of XA

C - 5246 - approx 61.8% of AB

Holding C, Proj for D:

38.2% - 5164

50% - 5139

61.8% - 5113

78.6% - 5077

88.6% - 5056

SYNOPSIS: THE SL FOR CURRENT POSITIONAL LONGS TO BE TRAILED TO EOD CLOSE BELOW 5210 - Corresponding to Day HEMA & 20 DMA.

Aggressive sell at current Levels - 5225NS with Sl above 5250 - Previous High. If EOD close is below 5205 then the shorts are carried over positionally for the last leg D of the Bullish Bat Pattern.

CHECK LIST-DAY CLOSE 5241 5 SMA 5162 PIVOT 5233 5EMA 5193 HI EMA 5210 10EMA 5181 LOW EMA 5151 13EMA 5183 prev HI 5246 20 Hr MA 5207 prev LOW 5213 50 Hr MA 5149 20 DMA 5213 100 Hr MA 5179 100 DMA 5153 200 Hr MA 5212 200 DMA 5105

Trade Table Current pattern X-A B C (current) BULLISH BAT PATTERN 4770-5349 5032 5246 Trade initiated SL EOD close BELOW 5210 BOUGHT AT 5130NF JULY 27 Proj for D 38.20% 5164.00 aprrox 100 DMA 50.00% 5139.00 Week HEMA 61.80% 5113.00 approx Mon LEMA 78.60% 5077.00 month Hema Sell at 5225 NS - aggressively with Sl above 5250 prev high.

The Upmove in Rising wedge is resited by the TRENDLINE.

Analysis for August 2:

Nifty Closed the July month well above the Month 5 EMA and 20 DMA. While it is trying to defend the 20 DMA, Nifty is struggling hard to breakout above the 61.8% retr level of 5246 too. More upsides possible only on a breakout above 5246. Weak below 20 DMA.

The Rising wedge (CLICK HERE for july 31 chart) seems to have Broken and as per the charts of July 31 (CLICK HERE) - the Alternate 2 seems to be in place till 5246 above 61.8% is taken upward.

The Hour14 RSI and Hour Fmacd charts also exhibit -ve divergences - so breakdown of the rising wedge seems to be a possibility.

Bullish Bat Pattern:

Bullish Bat Pattern:XA - 4770 - 5349

B - 5032 - 50% of XA

C - 5246 - approx 61.8% of AB

Holding C, Proj for D:

38.2% - 5164

50% - 5139

61.8% - 5113

78.6% - 5077

88.6% - 5056

SYNOPSIS: THE SL FOR CURRENT POSITIONAL LONGS TO BE TRAILED TO EOD CLOSE BELOW 5210 - Corresponding to Day HEMA & 20 DMA.

Aggressive sell at current Levels - 5225NS with Sl above 5250 - Previous High. If EOD close is below 5205 then the shorts are carried over positionally for the last leg D of the Bullish Bat Pattern.